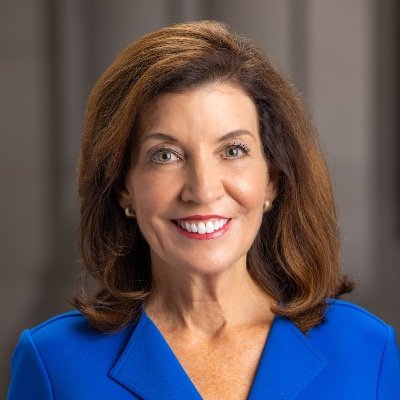

New York Governor Kathy Hochul has vetoed legislation that would have strengthened the New York False Claims Act.

New York is one of the few states that have a False Claims Act that applies to taxes. Individuals and corporations that knowingly file a false tax form are liable under the New York law.

But there is a loophole — individuals and corporations that fail to file any tax returns at all escape liability.

In June 2021, the New York legislature passed legislation (S.4730 and A.2453) that plugged that loophole for corporations and individuals with net income or sales over $1 million.

But the big four accounting firms and their trade group, the American Institute of Certified Public Accountants, argued that the law was overly broad and could apply to accounting firms.

“I am fully supportive of efforts to detect and penalize illegal or improper tax filing practices,” Hochul said in her veto message to the Senate. “The sponsors indicate their goal is to capture those individuals or businesses who improperly avoid tax obligations by not filing any tax returns at all. However, the language in the bill is broader than impacting only non-filers, and would implicate more tax filing controversies to the False Claims Act than just non-filers. This would be incongruent with the way other states and the federal government pursue False Claims Act violations, and could have the effect of incentivizing private parties to bring unjustified claims under the law.”

“There are administrative and criminal remedies in the law currently that address this conduct. I agree nonetheless that continued efforts need to be made to address non-filers, and I am fully supportive of the sponsors’ efforts to address a potential oversight in the State’s laws that may incentivize non-filing of taxes.”

Hochul added that “in this time of great uncertainty for businesses, I cannot support a bill that may have these unintended consequences.”

Neil Getnick, the managing partner of Getnick & Getnick, an anti-fraud law firm with a strong whistleblower practice, told Corporate Crime Reporter that “while this may be a time of great uncertainty for businesses, one thing is for certain — it is no solution to allow businesses which are tax cheats to compete unfairly with law abiding businesses which pay their taxes.”

“That only exacerbates the situation,” Getnick said.