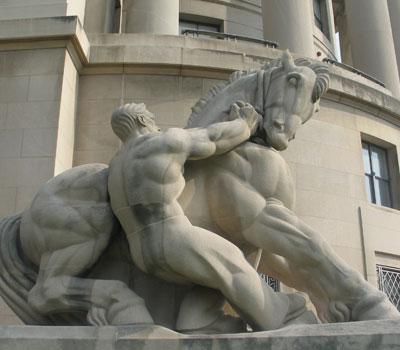

Walking down Pennsylvania Avenue in Washington, D.C., tourists come across a giant statue of a man trying to control a giant horse. The statue is called – Man Controlling Trade.

Most of those tourists probably don’t have a clue that the statute sits outside the Federal Trade Commission (FTC) building – the agency created during the new deal to bring a semblance of law and order to large corporations.

Samuel Levine understands the meaning. Levine is the director of the FTC’s Bureau of Consumer Protection.

“There is a reason Man Controlling Trade is in front of the FTC building,” Levine told Corporate Crime Reporter in an interview last month. “That’s what we were set up to do. That is what we were created to do. I consider the FTC one of the real crowning achievements of the progressive era more than a century ago.”

“Congress wanted the FTC to be a check on corporate abuse, to be a champion for honest businesses and fair markets. And we have done that undeterred by some of the rhetoric we hear. There is a lot of chatter out there. But we try to stay focused on the work.”

Since graduating from Harvard Law School in 2012, Levine has spent his entire career in the field of consumer protection.

He was at law school during the fallout from the financial crisis. “I became involved in anti-foreclosure work,” Levine said. “I was representing homeowners and tenants who were facing displacement as a result of foreclosure. But I was also working with community organizers, working on legislation, and working on other policy issues around the crisis. I saw first hand how banks were ripping people off and how the government had failed to protect people in the years leading up the crisis, failed to help people during the crisis and failed to hold accountable the big banks and executives who got us into the crisis. So I became passionate about that work.”

“I then went to work for the Illinois Attorney General. My focus there was on student debt. I was involved in a prosecution of some major for profit colleges. When I was there, I got to know the student loan ombudsman for the Consumer Financial Protection Bureau – Rohit Chopra. And that became relevant later in my career when I joined the Federal Trade Commission.”

“I joined the FTC in 2016. I was a staff attorney in the Chicago office, where I continued to work on student debt cases and some privacy cases. I later moved to Washington D.C. to become an attorney advisor to then Commissioner Chopra.”

“Fast forward a couple of years, Commissioner Chopra becomes head of the CFPB and Lina Khan becomes chair of the FTC. And chair Khan appointed me to lead the Consumer Protection Bureau at the FTC. And that was a little more than three years ago. And I remain in that job today.”

The FTC is one of a handful of enforcement agencies that go after major corporate wrongdoing, maybe up there with the SEC and the CFPB and the Justice Department.

What’s your budget and staffing like?

“People call the FTC a dual mission agency. We have consumer protection and competition enforcement. I think of it as single mission enforcement – making markets more fair. But our core authority is to challenge unfair methods of competition and unfair ads acts and practices.”

“The FTC is a little more than 1,300 people, so we are really quite small. We are actually smaller than we were in 1980, which I don’t think is an accident. There was a real effort to shrink the agency during the 1980s and do less consumer protection and less antitrust enforcement.”

“In our Bureau of Consumer Protection, we have about 440 or so people. Most of them are lawyers, but we also have paralegals, consumer education specialists and technologists. We worked closely with economists as well.”

“It’s fairly big as far as a law firm goes, but fairly small as far as an agency responsible for almost the entire economy.”

“On consumer protection, we have jurisdiction over the whole economy, with a couple of exceptions – national banks, non profits, insurance companies and common carriers. Other than that, it is a broad jurisdiction. And so we have a lot of work to do. We do fraud cases, privacy, artificial intelligence, dark patterns, false advertising, energy labeling, motor vehicle sales. It’s a broad jurisdiction with a small team. And I like to think we punch above our weight.”

How would you compare your enforcement authority budget with the other key players in the field – SEC, CFPB, Justice Department, state Attorneys General?

“We are significantly smaller than the SEC. We are smaller than the CFPB, but that’s closer. We are bigger than the consumer protection branches in state AG offices. We partner with state AGs quite a bit. We also partner with the CFPB quite a bit. Often, given our limited resources, it makes sense to join forces with other agencies.”

Does the FTC have an enforcement staff?

“The FTC has eight divisions and eight regional offices around the country. All of the regional offices do enforcement and five of the divisions do enforcement. We also have a consumer education division. We have a division of litigation and technology. And we have a division of consumer response and operations, which runs our consumer sentinel complaint database.”

“We mostly do enforcement, but we also do rulemaking, education and other activities.”

You don’t have criminal enforcement authority. Do you have staff that deals with the Justice Department?

“We do. We have a criminal liaison unit. We regularly refer our cases to U.S. Attorneys, to Main Justice, as well as to state and local prosecutors. And we put out a report every year about our criminal referrals.”

What would be the ideal budget and staffing to deal with the caseloads you are looking at?

“The Commission put forward its budget request to Congress. I don’t remember the exact number, but it was a little over $500 million.”

“Throughout this interview, I’m only speaking for myself and not for the Commission or any Commissioner. We need vastly greater resources. Our country does not have, for example, a privacy regulator. That falls to us. We have a small team in our privacy unit – it’s fewer than 50 people. There are countries far smaller than the United States – like the UK – that have vastly more people working on privacy.”

“Fraud and scams are a huge problem in this country, which social media has accelerated and which AI threatens to accelerate further. We need a lot more cops on the beat to take those challenges on. I don’t want to give you a number, but we should be much larger than we are. We are a great deal for taxpayers and consumers. We routinely return more money to consumers and taxpayers than we take in to our budget. If Congress armed us with more resources, we’d be able to protect people from more harm and return even more money to the public.”

What’s the FTC’s current budget?

“About $425 million. It sounds like a lot, but when you think about the size of our economy and the size of the federal budget, we could use a lot more.”

What part of the $425 million goes to consumer protection?

“I would guess about a third of it, maybe a bit more.”

When you go up against these companies, they rarely go to court, right?

“We are in court quite a bit. We are in court, for example, against TurboTax right now. The company is Intuit. We alleged that all of those free free free ads that you see on TV or online are misleading people. We are in litigation right now in dozens of cases.”

“We settle more cases than we litigate, but people know that we have a really good track record of winning in court. But we are not afraid to litigate. And we do so quite a bit.”

Former FTC chair Michael Pertschuk gave a speech in 1981 titled – Consumer Strategies for the 80’s: The Renewal of Consumer Outrage and Regulatory Legitimacy. In it, he says that “the public is disinclined to equate corporate behavior, no matter how deliberate or injurious, with street crime.”

Why do you think corporate crime, corporate wrongdoing is not front and center in politics?

“If a thief pickpockets you and steals $25, we think of that as street crime,” Levine said. “We get angry over it. People think they should face criminal consequences. But when you are a large corporation and you ripped people off for hundreds, thousands and sometimes tens of thousands of dollars, their whole life savings – it’s a corporation, the CEO wears a suit, there’s a board and they take out advertising, somehow that makes it okay.”

“I do think this is a challenge. I take corporate abuses seriously. I started out compassionate about consumer protection. But that passion started with anger. My clients, who were struggling to stay in their homes, could not get a bailout because of a so called moral hazard. If they got principal reduction on their loans, somehow other debtors would get the message that they don’t have to pay on their loans on time.”

“Meanwhile these massive banks, who ripped people off to the tune of hundreds of millions, even trillions of dollars, got a huge bailout – 100 cents on the dollar. None of those bank executives faced any prosecution. And most of them kept their bonuses. Talk about moral hazard.”

“So I do think we have a problem with how white collar crime is seen differently than street crime. I agree with Chairman Pertschuk on that. It is a message you at Corporate Crime Reporter have been effective in relaying. But there is a lot more to do in helping people to recognize that just because someone is wearing a suit, just because someone works in a fancy office, doesn’t mean they are not a crook. Some of the worst crooks in United States history in terms of how much they cheated people, the harm they caused, the lack of remorse, have worked out of board rooms. I hope there is more attention to that.”

Has there been a concerted effort by the corporate lobbyists in DC to counteract your more aggressive enforcement?

“Certainly. And I don’t want to veer too far into politics because it’s above my pay grade. But we certainly see a number of interests, not only fighting back against our lawsuits, which is their right as Americans. But they also argue that our agency is unconstitutional, that our commissioners are unconstitutionally appointed. We issued a ban on non competes. We already have had challenges to that ban. I’ve read a lot of angry commentary from certain groups in D.C. We also hear from small businesses that benefit from our work. These are small businesses that know they are struggling to compete with big corporations, small businesses that are being ripped off by scammers, small businesses that are getting cheated by competitors who advertise falsely when the small businesses are trying to tell the truth.”

“I certainly think there are groups in D.C. that have fought us pretty hard. But there are a lot of honest businesses out there who support what we are doing, that want the marketplace to be fair. They know that if they are honest and they are playing by the rules, they are going to have a chance to compete if the market is more fair.”

How many big corporate firms have a dedicated FTC defense practice?

“It’s growing. If you look at the top law firms in the country, most of them will have FTC defense practices. The firms we go up against all the time – Kirkland & Ellis, Latham & Watkins – many more. And folks have told me from these firms that we are keeping them very busy.”

“But everyone has a right to their day in court. Dialogue with the bar is important. There is no question that we are keeping a lot of firms really busy and that many of these firms have either expanded or launched their FTC practices.”

Are you sensing that the FTC defense bar is now more willing to go to court than they were a couple of years ago?

“That might be true. There is a perception that enforcers don’t want to litigate. But there is recognition by the bar that the FTC is not afraid to litigate, not only against smaller companies. We are in litigation against some of the largest companies in the world. We are in litigation with Amazon right now, we are in litigation with Meta, with Intuit, Microsoft on the competition side. It’s gone both ways. We continue to litigate when we need to litigate. And we continue to settle a lot of cases as well. But I don’t think anyone regards us as gun shy or afraid to go to court.”

“Mike Pertschuk called the FTC the greatest public interest law firm in the country. And that’s what we are. We will go head to head against any law firm representing any corporation in the country.”

[For the complete q/a format Interview with Samuel Levine, see 38 Corporate Crime Reporter 32(11), August 5, 2024, print edition only.]