Better Markets has just released a report – Wall Street’s Six Biggest Bailed-Out Banks: Their Rap Sheets and Ongoing Crime Spree.

The report, for the first time, details six large bank taxpayer bailouts, the crime spree before, during and after the 2008 financial crisis, and the fines and penalties involved.

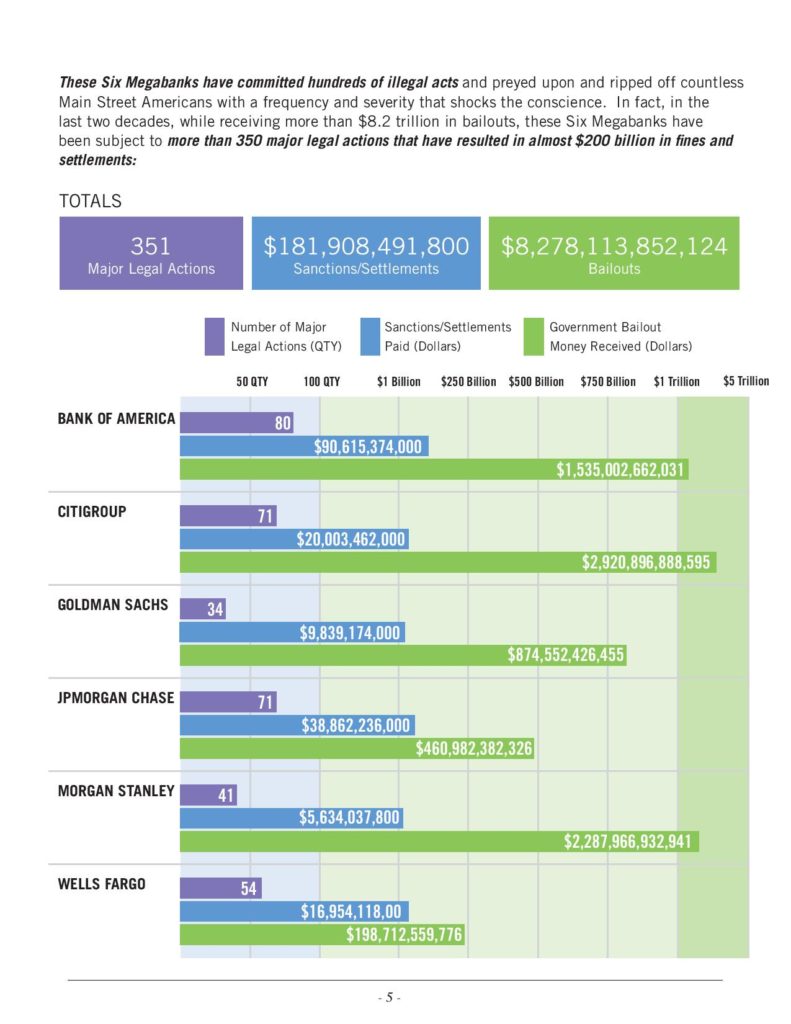

“This report details, for the first time, that, of the more than $29 trillion in total bailouts, the six biggest banks in the country – Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo – received more than $8.2 trillion, or nearly one-third of the total bailouts provided to the entire financial system,” said Dennis Kelleher, President of Better Markets.

“These bailouts were sold to the American people as necessary to prevent the collapse of the financial system and to ensure that these banks continued to lend to the real economy. However, as the report also details, these six megabanks have engaged in an unrelenting crime spree. It started before the 2008 crash, continued during the crash, and the number of major legal actions against these Six Megabanks has actually increased after the crash, as shown in the chart below.”

“Bernie Madoff was sentenced to 150 years in prison for one Ponzi scheme, yet these Six Megabanks have engaged in decades of ongoing illegal activities without any meaningful penalties,” Kelleher said. “This shows that being saved from bankruptcy with $8.2 trillion in bailouts and that the almost $200 billion in fines, penalties and settlements simply haven’t slowed their ongoing illegal conduct.”

“One might think that receiving trillions of dollars of undeserved and lifesaving taxpayer bailouts would cause those financial institutions to reform their high-risk, destabilizing activities or, at a minimum, to rein in their predatory conduct and illegal practices. Think again. The banks showed no gratitude, no remorse, and no willingness to reform their activities,” the report found.

“Worse, they also didn’t bother to end their systemic, widespread, and brazen illegal conduct. In fact, they have engaged in – and continue to engage in – a crime spree that spans the violation of almost every law and rule imaginable. Taking the breadth and depth of their illegal conduct as a whole, the six biggest banks in the country look like criminal enterprises with rap sheets that would make most career criminals green with envy. That was the case not just before the 2008 crash, but also during and after the crash and their lifesaving bailouts. In fact, the number of cases against the banks has actually increased relative to the pre-crash era.”